Running a business requires making informed decisions. So understanding your finances, especially liabilities to achieve your goals is a must. The finances of a business involve a lot of things like tax provisions.

Tax provision ensures that your company’s financial performance is accessible to management and shareholders. The tax provision, especially the income tax provision, is also an interface between financial statements prepared under GAAP and actual tax liabilities. It enables companies to plan based on a more accurate representation of finances.

However, it is often misunderstood. Therefore this blog explains what tax provision is, how it’s calculated, and the challenges. Read further for the key details every business owner or finance manager should learn about tax provisions.

Tax Provision Meaning: Understanding Tax Provision

A tax provision is a pre-estimate of taxes a firm would pay to the government during a particular accounting period. It ensures a business saves enough funds to handle its tax obligations and avoid unexpected tax liabilities. Tax provision focuses on factors like current/deferred taxes, permanent/temporary differences, and changes in tax laws.

In simple words, it is a process of calculating income tax expenses both for current and deferred periods. The provision is an expenditure on the company’s income statement. It reflects the tax a company expects to pay or will pay in future periods. This estimate is needed for financial statement preparation so that earnings and liabilities are correctly reflected.

Tax Provision = Taxable Income * Current Tax Rate + Deferred Tax Expense

- Taxable Income: This would be the overall amount of income that needs to be taxed.

- Current Tax Rate: Corporate tax rate in effect for the year being accounted for.

- Accrued and Payable Taxes: These are taxes payable in future periods, as there are differences in treatments accorded to income and expenses both for accounting and tax purposes.

What Do You Need to Calculate Tax Provision?

To calculate the tax provision, gather specific details about your business’s financial situation. Here are the key components that must be considered:

- Provision for Income Taxes for the Current Year: Income tax is provided for the current period. So, it is decided based on taxable income for the year and the rate of tax prevailing for the period.

- Deferred income tax expense: It is an adjustment account. This is due to the varying recognition of income and expenses on the different statements and the realization of values for tax purposes.

- Permanent differences: Those differences that relate to taxable and accounting income and do not reverse. Examples include fines and penalties as well as entertainment among others.

- Temporary Differences: These are differences in timing arising from variations between accounting income and taxable income. These differences reverse over time. For example, the difference in accounting depreciation and tax depreciation falls within this category.

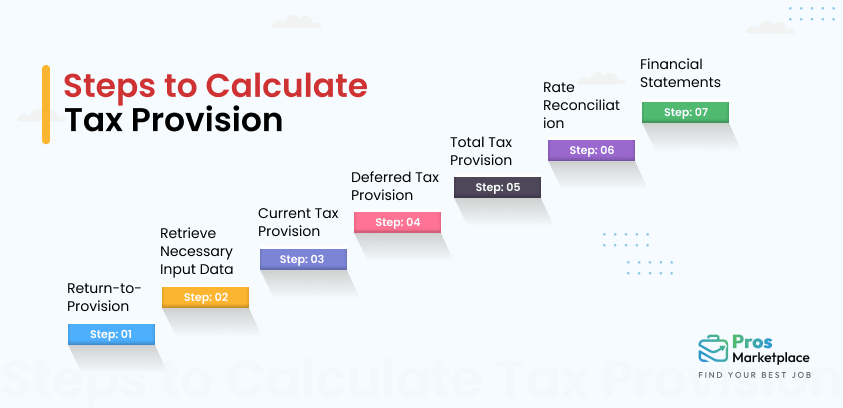

Calculating Tax Provision: Step-by-Step Guide

Computing a tax provision is a step-by-step process that requires full attention and the correct amount of data. Below are the steps used in computing a tax provision. Don’t forget to pay attention to this step so that the financial statements reflect correct estimates about the company’s total taxes paid. Let’s explore each step in detail.

Step 1: Return-to-Provision

The first step is the return-to-provision process. This is a reconciliation process that ensures that the differences in the prior year’s tax return and the prior year’s tax provision are addressed. This is reconciling the financial records for the final tax liability, which may have been different from the initial assessment.

Most of the time, the tax return is prepared a few months after the initial tax provision. The return-to-provision validates these numbers and changes the financial statement to reflect the true tax obligation for the prior period. This is done once a year to get the books and records up to date.

Step 2: Retrieve Necessary Input Data

Once this return-to-provision step is undertaken, the next step is to gather all the data so that the company can determine the tax provision for the current year. Most noteworthy here is the trial balance, which is a detailed listing of all financial accounts of the company—income accounts, expense accounts, or items on the balance sheet.

Apart from the trial balance, there are other financial schedules that the tax department requires. Perhaps there are fixed assets and intangible asset details and stock compensation to include in the computation. Gathering information from all business unit departments ensures that the tax provision is complete based on the financial data.

Step 3: Current Tax Provision

The computation for the current tax provision follows after all the gathering. This is a figure of how much tax the company ought to pay for the current year. The accountants do this by adjusting before-tax income garnered from the trial balance according to tax laws.

Generally, permanent and temporary differences stem from the differences between financial reporting under accounting principles (GAAP) and tax laws. Permanent differences refer to income or expenses shown in the financial statements without any consequence to taxable income. Temporary differences apply to items that affect the taxable income for the period but reverse out in later periods.

Step 4: Deferred Tax Provision

The next one is the deferred tax provision. This one counts the future tax payables or benefits that arise from a temporary difference. The deferred tax asset or liability represents the amount of taxes paid or saved in the future because of differences between accounting income and taxable income.

Differences in deferred tax provision represent the changes between the company’s deferred tax assets and liabilities during the year. These changes happen as a result of the reversal of temporary differences, either through the depreciation of assets or income being recognized on a different schedule for tax purposes. Deferred taxes reflect only temporary differences.

Step 5: Total Tax Provision

Once the current tax provision and the deferred tax provision are derived, the addition of these two permits a calculation of the total tax provision. That is the net tax expense that will appear in the income statement of the corporation. It covers the amount of tax liability that would have been presumed to be payable in the current year as well as tax liability in future years.

This step puts into perspective the total tax expense for that year. It helps management and shareholders get a clear view of the total tax burden the company faces.

Step 6: Rate Reconciliation

Another step is to find out the company’s effective tax rate. This is calculated using the total tax provision and the pre-tax income.

It is done by a tax professional performing a rate reconciliation. The reconciliation compares this rate with the actual effective tax rate of the company. Items that cause a gap between the statutory and effective rates are identified as causes, such as state taxes, foreign tax rates, or permanent differences.

Step 7: Financial Statements

The final step is adding this tax provision to the company’s financial statements. Details—such as reconciliation of the rates and any significant changes in the deferred tax assets or liabilities—are also usually included in the notes to the financial statements.

This process will ensure that the financial statements resulting from the company’s accounting activities reflect the tax liabilities as accurately as possible. Thus it gives management and shareholders full confidence in the correctness of the financial reporting.

Challenges to Tax Provision

The tax provision is a major component in financial planning but also has some difficulties. The biggest challenge is keeping in sync with the constant changes in tax laws and regulations. Tax codes often change from year to year, making it difficult to predict the company’s future tax liabilities more precisely. Calculation of deferred tax liabilities and assets also becomes complex when there are temporary differences between tax and accounting treatments.

Another challenge is documentation related to tax compliance. Documentation is essential for audit and regulatory purposes, and errors in tax provision calculations may cause expensive charges like penalties or fines from tax authorities or restatements of financial statements. Some other challenges include:

Tax audits and investigations: Tax audits and investigations can take significant time and be cost-intensive, leading to operational delays.

Transfer pricing: Interrelated entities of multinational companies undergo complex procedures and are closely examined by tax administrations. Transfer prices among related entities must be accurately identified to avoid penalties.

Tax controversies: Companies may find themselves in disputes with tax authorities, leading to potential legal costs and risks of additional tax penalties.

Tax planning: Strategic tax planning is necessary to avoid overpaying. Without proper planning, companies may end up with large tax bills that could have been minimized.

Tax Provision Checklist: Tips For Improving Tax Provision Calculation

The tax provision is a decision factor in the financial growth of your business.

So to make the process much simpler and to reduce errors in tax provision calculations, here are a few tips:

Understand the tax laws: Ensure you or your teams are current with changes in the tax laws that impact your tax provision, whether in the reduction of corporate tax rates, the reductions in the deductions, or the credits.

Use Software for Tax Calculations: Specialized tax calculating software automates complex figure calculation. It also updates your data with the latest tax laws and regulations. This increases accuracy and efficiency and saves precious time. It can also give highly detailed reports. This makes it easier to manage tax provisions.

Record Everything: Maintain all information related to taxes with records of permanent differences, temporary differences, tax payments, and the adjustments done while calculating.

Seek Tax Professionals: Hire the best tax experts to ascertain that your tax provisions are accurate and do not conflict with the latest legislation put into action.

Hire the Best Professional for Tax Provisions

Tax provision calculations can be very complex, especially for businesses handling large sums of income, expenses, and deductions. Hiring a skilled professional can ensure accuracy and compliance with tax regulations. A tax expert can help minimize liabilities and prevent costly mistakes in the ever-complicated tax landscape.

If you are looking for qualified tax provision experts, Pros Marketplace is the right platform for you. We connect employers and skilled professionals across Latin America.

Conclusion

Even if you know what is a tax provision, the calculations can be very complex, especially for businesses handling large sums of income, expenses, and deductions. Hiring a skilled professional can ensure accuracy and compliance with tax regulations. A tax expert can help minimize liabilities and prevent costly mistakes. At Pros Marketplace, we make finding qualified tax provision experts simple and efficient.