HR professionals face numerous challenges, including managing remote and hybrid work arrangements, handling employee departures and layoffs, and more. Amid these changes, wage compensation remains a constant concern as employees increasingly demand fair, transparent, and equitable wages.

HR leaders are tasked with the delicate balance of attracting new talent with market-competitive offers while maintaining consistency with their compensation strategies and ensuring existing employees are fairly compensated. Getting this right can enhance an organization’s reputation as an employer that offers attractive compensation and benefits and values its workforce. However, any mistake can lead to issues such as salary compression.

What is salary, wage or pay compression?

Pay compression occurs when differences in compensation among employees do not accurately reflect their experience, skills, or responsibilities. This phenomenon, also known as salary or wage compression, can manifest itself in various employee groups.

Pay compression refers to the leveling out of a company’s salary structure. It typically occurs when high starting salaries are coupled with modest wage increases.

Pay compression, also known as wage or salary compression, may not be immediately noticeable without a comprehensive audit. Some indicators of compression issues include:

- Newcomers earn the same or more than existing employees in identical roles.

- The salary gap between a current role and a promotion is not substantial enough to motivate increased responsibility.

- Minimal salary difference between a manager and their direct reports.

- Lower-level employees earn nearly as much as their colleagues in higher-level positions.

- Non-exempt workers, who accrue overtime, earn more than their exempt counterparts.

Pay Compression: Understanding its Drawbacks

Pay compression can have serious repercussions on your salary budget. Compression issues typically arise when discipline is lacking, such as when hiring managers offer salaries above average.

However, compression can also have far-reaching effects on your entire team. Some common issues include:

Reduced Engagement: Pay compression can often feel unjust because everyone earns the same, irrespective of their input. Fairness affects engagement; employees are 26% more productive when they perceive fair treatment, which also impacts retention.

Diminished Participation in Professional Development: While professional development is rewarding, individuals require achievable development goals. They are less likely to participate in leadership development, for instance, if managers earn the same as their direct reports.

Risk of Discrimination Action: While pay compression is not illegal, it can indicate systemic pay equity issues. If one group is underpaid and another is overpaid, this could potentially signal discrimination or exclusion.

With the increasing prevalence of pay transparency laws, it is becoming more challenging to hide pay compression. As such, it is crucial to proactively prevent compression issues.

Reasons for Wage Compression

Salary compression is no accident; it is often the result of various practices. Let’s examine some key factors and analyze how they impact your wage structure:

Rise in Minimum Wage:

Minimum wage increases are a double-edged sword. Improving the quality of life for low-income individuals may impact the operating budget. A complete change of wages may not be possible, especially for organizations with low profitability. This situation could result in long-time workers receiving incremental raises over time but still ending up with salaries lower than the new minimum wage, leading to a negative and unjust perception.

Corporate Mergers and Acquisitions:

Mergers and acquisitions are good for growth, but working with different compensation strategies during mergers can be a challenging task. One company may offer a generous salary and bonuses, while another may offer a lower salary but focus on improving performance. Unless the salary structure is carefully reviewed and adjusted, some pressure will occur. Employees of the acquired company, especially senior employees, may find their salaries falling behind their colleagues in the new organization, leading to dissatisfaction.

Talent Acquisition in a Competitive Market:

Attracting top talent in a competitive business often requires offering competitive starting salaries. This may be a necessary evil, but it can also ensure fair pay. Consider a scenario where a new employee with no experience is paid nearly the same as or even more than an experienced employee who significantly contributes to the success of the organization. This disparity can negatively impact the morale and integrity of existing employees, potentially reducing their productivity and increasing the risk of them seeking opportunities elsewhere.

Inadequate Compensation Strategy:

Lack of clarity on salary can lead to salary compression. Without a framework that considers factors such as market value, experience, and performance, it can be challenging to maintain competitive salaries over time. This situation can lead to long-term workers whose wages do not keep pace with the economy, causing them to earn as much as or even less than new workers in comparable positions. Failure to recognize their experience and dedication can frustrate and hinder employee retention efforts.

Disproportionate Additional Compensation:

Providing extra money through overtime pay can incentivize work and address turnover. However, dependence on overtime, particularly for low-skilled workers, can affect the total wage expenses. Perceptions of inequality may arise when overtime pay causes low-income workers to earn close to or more than the wages of their higher-income colleagues. Not only does this lead to older workers, but it also makes it harder to negotiate different salaries based on experience and role.

Addressing Wage Compression in Your Small Business: 3 Easy Steps

Wage compression, where seasoned employees earn salaries close to, or even less than, new hires in similar roles, can cause significant challenges for small businesses. But don’t wait until unhappy employees and low morale become obvious signs! Here’s a proactive, three-step plan to identify, address, and prevent wage compression in your company.

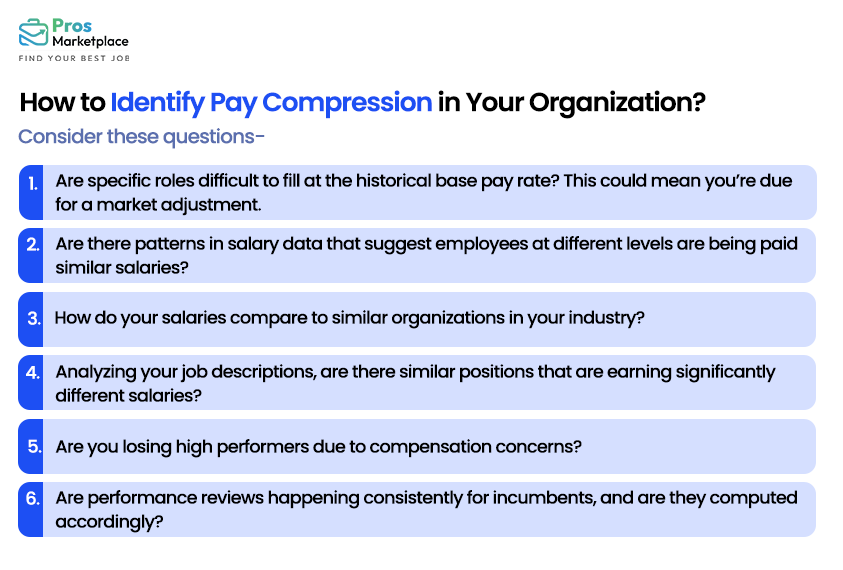

Step 1: Stay Alert – Conduct Regular Salary Checks

Think of regular salary checks as maintaining the health of your compensation system. Schedule regular reviews to identify potential pay disparities and ensure equitable compensation.

Here are some straightforward questions to consider during these checks:

Fairness: Do salaries for experienced managers match those of new managers? Is there a fair and steady increase based on experience and performance?

Market Comparison: How do your wages compare to others in similar positions? Do you need to adjust for regional or industry differences?

Future-Proofing: Are there upcoming changes in the minimum wage or inflation that might require adjustments to stay competitive?

Know Your Competition: What are similar companies paying their new hires? This will help you assess the attractiveness of your offers.

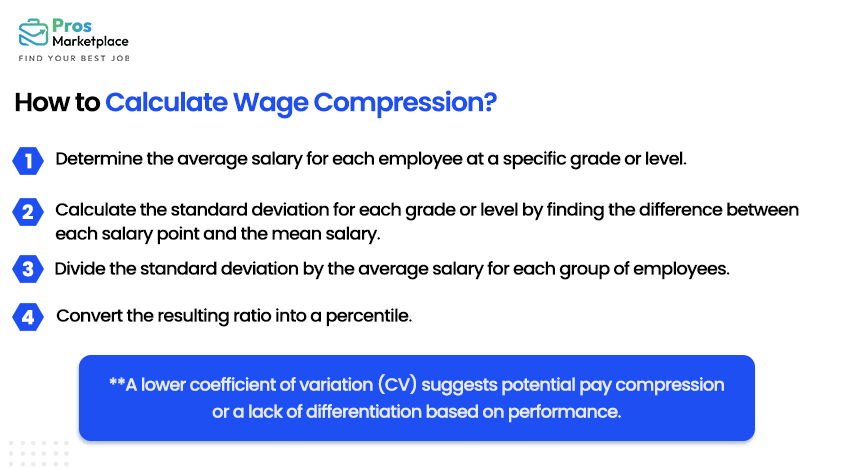

How to Calculate Wage Compression

Calculating pay compression is essential for maintaining fairness in compensation structures. One method to gauge this is by using the coefficient of variation (CV). Here is a simplified guide on how to calculate it:

Step 2: Create a Fair Pay Plan

Once you know where your pay stands, it’s time to ensure it’s fair. Here are some things to think about.

Fairness for Everyone: Are long-time staff members being compensated adequately for their experience and loyalty? Are new hires being paid too much for their experience?

Adjustments: Is giving everyone a raise the best solution, or should adjustments be made to specific positions to address pay compression?

Market Check: Examine the current job market and analyze competitor salaries. This will help you decide if raises are possible.

Think Outside the Paycheck: Can you offer perks such as flexible hours, health benefits, or learning opportunities to keep staff happy?

The aim is to create a pay plan that is fair to both new and existing staff. You might need to increase pay for some employees while reducing the frequency of raises for others. The key is finding a balance that is fair and sustains the operation of your business.

Step 3: Pay Means More Than Money

While a good salary is important, remember that pay includes more than just money. So, it’s important to consider other factors as well. Here are some ideas:

Time Off: Consider granting longer-serving staff additional vacation days or allowing them to work flexible hours.

Better Benefits: Offer enhanced health coverage or gym memberships to promote the well-being and satisfaction of employees.

Invest in Learning: Support your staff’s growth by funding training courses or conferences. This shows that you care about their careers.

Reward Good Work: If regular raises are not possible, consider rewarding exceptional work by providing bonuses or other incentives for outstanding performance.

By being proactive about wage compression, small businesses can create a fair pay system that keeps staff happy and motivated. Remember, a good pay plan is an investment in your most important asset—your team.

Conclusion

Regular monitoring is crucial for evaluating the extent of salary compression. Most companies should conduct annual analyses, while those experiencing more acute issues may need biannual reviews, especially if turnover rates are high or hiring is frequent.

Ultimately, companies that take proactive steps to address wage compression and disparities, while fostering pay transparency and effective communication, are likely to attract top talent. Offering competitive compensation not only strengthens the employer brand but also cultivates a workforce of motivated and engaged individuals, driving overall productivity and success.

Also Read: How to Negotiate Your Salary?